|

Back to Blog

How Much Do You Really Know About Long-Term Care? Separating some eldercare facts from some eldercare myths. Provided by Michael Fox How much does eldercare cost, and how do you arrange it when it is needed? The average person might have difficulty answering those two questions, for the answers are not widely known. For clarification, here are some facts to dispel some myths. True or false: Medicare will pay for your mom or dad's nursing home care. FALSE, because Medicare is not long-term care insurance. 1 Part A of Medicare will pay the bill for up to 20 days of skilled nursing facility care - but after that, you or your parents may have to pay some costs out-of-pocket. After 100 days, Medicare will not pay a penny of nursing home costs - it will all have to be paid out-of-pocket, unless the patient can somehow go without skilled nursing care for 60 days or 30 days including a 3-day hospital stay. In those instances, Medicare's "clock" resets. 2 True or false: a semi-private room in a nursing home costs about $35,000 a year. FALSE. According to Genworth Financial's most recent Cost of Care Survey, the median cost is now $85,775. A semi-private room in an assisted living facility has a median annual cost of $45,000 annually. A home health aide? $49,192 yearly. Even if you just need someone to help mom or dad with eating, bathing, or getting dressed, the median hourly expense is not cheap: non-medical home aides, according to Genworth, run about $21 per hour, which at 10 hours a week means nearly $11,000 a year. 3,4 True or false: about 40% of today's 65-year-olds will eventually need long-term care. FALSE. The Department of Health and Human Services estimates that close to 70% will. About a third of 65-year-olds may never need such care, but one-fifth are projected to require it for more than five years. 5 True or false: the earlier you buy long-term care insurance, the less expensive it is. TRUE. As with life insurance, younger policyholders pay lower premiums. Premiums climb notably for those who wait until their mid-sixties to buy coverage. The American Association for Long-Term Care Insurance's 2018 price index notes that a 60-year-old couple will pay an average of $3,490 a year for a policy with an initial daily benefit of $150 for up to three years and a 90-day elimination period. A 65-year-old couple pays an average of $4,675 annually for the same coverage. This is a 34% difference. 6 True or false: Medicaid can pay nursing home costs. TRUE. The question is, do you really want that to happen? While Medicaid rules vary per state, in most instances a person may only qualify for Medicaid if they have no more than $2,000 in "countable" assets ($3,000 for a couple). Countable assets include bank accounts, equity investments, certificates of deposit, rental or vacation homes, investment real estate, and even second cars owned by a household (assets held within certain trusts may be exempt). A homeowner can even be disqualified from Medicaid for having too much home equity. A primary residence, a primary motor vehicle, personal property and household items, burial funds of less than $1,500, and tiny life insurance policies with face value of less than $1,500 are not countable. So yes, at the brink of poverty, Medicaid may end up paying long-term care expenses. 4,7 Sadly, many Americans seem to think that the government will ride to the rescue when they or their loved ones need nursing home care or assisted living. Two-thirds of people polled in another Genworth Financial survey about eldercare held this expectation. 4 In reality, government programs do not help the average household pay for any sustained eldercare expenses. The financial responsibility largely falls on you. A little planning now could make a big difference in the years to come. Call or email an insurance professional today to learn more about ways to pay for long-term care and to discuss your options. You need to find a way to address this concern, as it could seriously threaten your net worth and your retirement savings. Michael Fox may be reached at 856-676-9358 or at [email protected]

0 Comments

Read More

Back to Blog

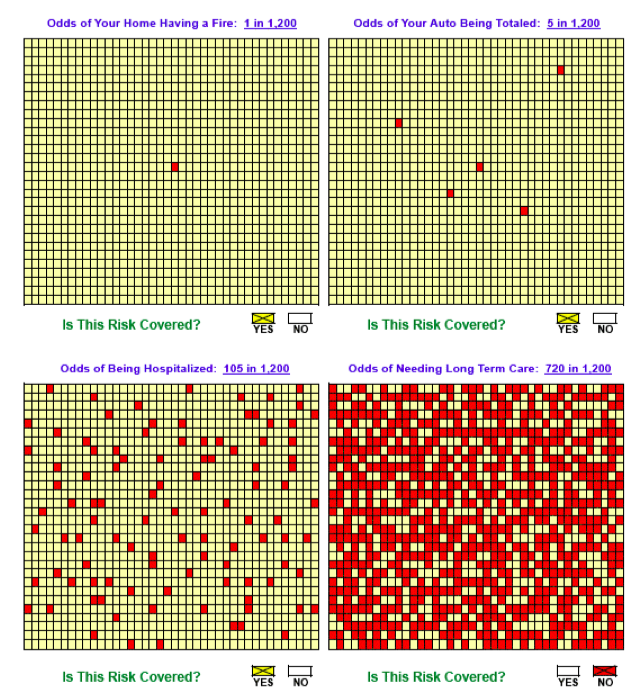

What is the chance?6/28/2018 Words can sometimes never express what a picture can. I have told clients before that it is important to protect themselves against a Long Term Care Risk. I can tell them the chances of needing long term care versus other life risks such as having a fire. The picture above tells the story perfectly.

Most of us have home insurance to protect against a fire. You buy the house, it is a valuable asset and you want to protect it against loss. The picture above shows us that we have a 1 in 1200 chance of your home having a fire. If we drive a car we need to have it insured. However, what the chart shows above is that you have a 5 in 1200 chance of totaling your car in an accident. These risks are minimal but yet we all buy the insurance to protect against the loss. Now the last image shows us the chance of needing long term care. That is, the odds we will have a life event, causing us to need nursing home or in home care. Those chances are 720 in 1200. That is a 60% chance of needing coverage which can cost close to six figures a year for a nursing home stay. My life is committed to helping others. To me, every person I get to invest in long term care coverage, I am doing a huge service. I can look in the mirror as well as look at my son and say I am doing what is necessary to make a difference in peoples lives. I have a friend, he is only in his 40's, his wife was diagnosed with an awful disease. She had no long term care insurance. He has tapped into their assets and it has been devastating to him financially. Please don't wait until it is too late to make a difference in your life and protect your assets and family. Please contact me for more information. Michael

Back to Blog

It's All About You6/22/2018 How many times have you been to a party or family gathering and there he is the insurance guy trying to drum up business? Do you try to get as far away from him as possible? You mean you don't feel like being sold? Who does?

Last time I checked we are all human beings and want to be treated with respect, kindness and as a human being. It's funny, most of the time that insurance guy above is talking to a person, they are doing all the talking and not even listening to the prospective client. They fail to ask any questions about the human being they just connected with, instead they see potential dollar signs. What a turn off to just about anyone. Wouldn't it be nice if that person at the party focused on you? They asked you questions about what is important in your life? What are your values? What makes you tick? Isn't that a much more human way to approach any relationship? At Michael Fox Insurance, it's all about you. I want to find out all about you. I want to understand what makes you tick. I want to understand you family and overall situation in life. Our first meeting is with a yellow pad and just a conversation about YOU! Unless we understand you, how could I possibly understand your needs. Without understanding your needs, I am just a salesperson. That would be my worst nightmare. Remember this, next time you are at that party and the insurance salesman approaches you. Let him know, it's all about me, not you! Call us for a complimentary consultation and lets begin a dialogue and relationship. Michael |

RSS Feed

RSS Feed